In this guide, we will discuss the essential steps of developing a comprehensive business plan, from drafting an engaging executive summary to defining your financial strategies.

By following these steps, you will be well-equipped to create a professional business plan that effectively conveys your business’s potential and sets the stage for long-term success. A writer is to be clear and concise when coming up with a business plan. Business plan writing can be done by professional companies that hire specialists as writers.

What is a Business Plan?

A business plan is a formal and strategic document that outlines the objectives, strategies, and operational and financial details of a business. It serves as an extensive guide for how the business will be structured, managed, and grown over time. When putting together a business plan, the goal is to create a detailed roadmap that communicates your business vision and offers a clear pathway to achieving it.

Drafting a business plan involves focusing on key components such as the executive summary, target market, competitive analysis, marketing strategies, and financial projections. Each section of the plan is designed to give readers, whether they are potential investors, lenders, or internal stakeholders, a thorough understanding of how the business intends to achieve its goals.

By systematically organizing your ideas and plans, a professional business plan helps to outline the steps necessary for turning your business concept into a reality.

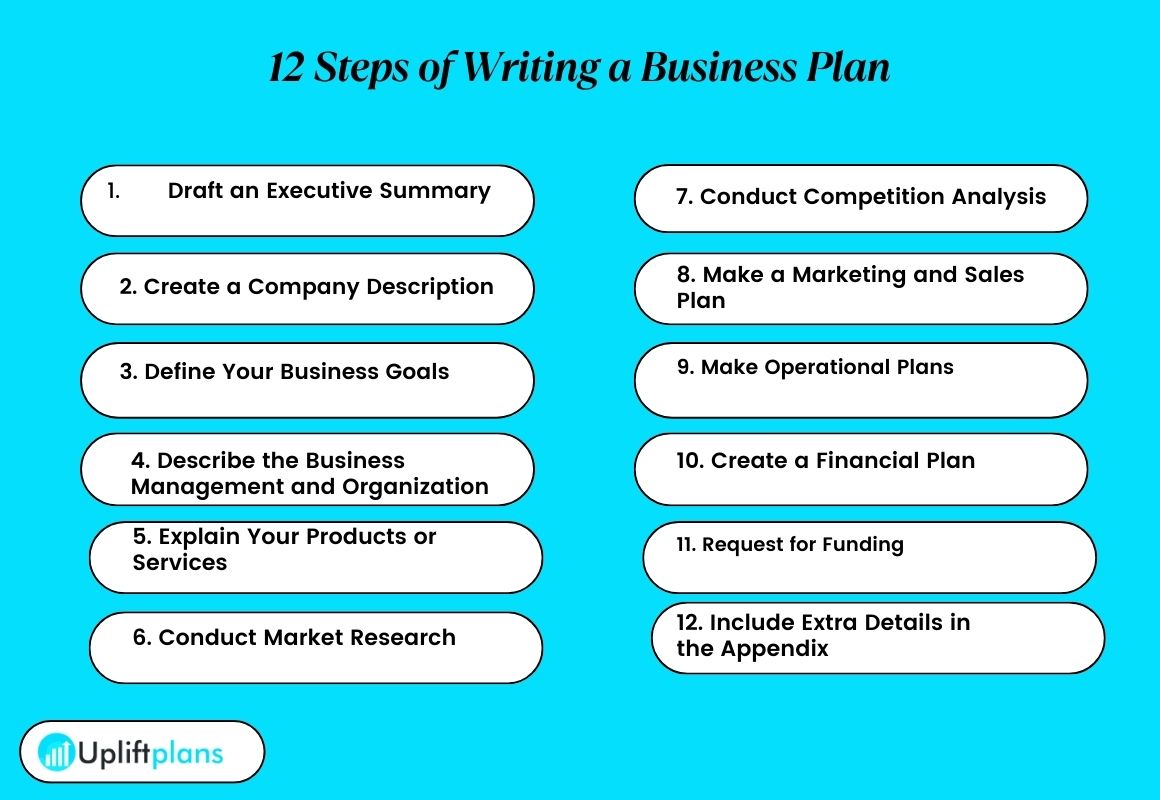

Steps On How to Write a Business Plan

When writing a business plan, it is essential to follow a structured approach to ensure that all key aspects are covered. This section will introduce you to the essential steps, focusing on the parts of a business Plan, understanding what a business plan should look like, the importance of designing the outline, and selecting the right format.

By keeping these elements in mind, you will create a business plan that is professional and reliable in conveying your business goals and strategies.

Below are 12 steps of how to write a business plan.

Step 1: Draft an Executive Summary

The executive summary is the opening section of your business plan, providing a brief overview of your entire plan. It’s designed to grab the reader’s attention and summarize the key points of your business.

The executive summary should be written last. This ensures that it accurately reflects all the details and insights from the other sections of the plan. The executive summary should be clear, concise, and to the point, giving a quick yet broad overview of your business.

What Should an Executive Summary Contain?

- Business Overview:A short description of your business, including its name and nature.

- Mission Statement: A concise statement of your business’s purpose.

- Products or Services: A brief summary of what you offer and what makes it unique.

- Market Opportunity: An outline of the target market and potential demand.

- Business Model: A snapshot of how your business will generate revenue.

- Financial Highlights: Key financial projections like revenue and profit.

- Goals: Main objectives of your business.

- Management Team: A quick introduction to your key team members.

Step 2: Create a Company Description

The company description section of your business plan provides a detailed overview of your business. It offers important information about what your company does, who it serves, and what sets it apart. This section helps readers understand the foundation of your business and its core identity by including essential details about your company’s structure, name, location, leadership, and the unique value it brings to the market.

When writing your Company Description, be sure to include the following:

- Business Name: Clearly state the official name of your business as registered.

- Business Structure: Specify the legal structure of your business, such as whether it is a sole proprietorship, partnership, LLC, or corporation.

- Business Address: Include the physical address of your business, as well as any other relevant locations.

- Leadership: Introduce the key members of your leadership team, highlighting their roles and the experience they bring to the company.

- Mission and Vision: Provide a brief statement about the mission and vision of your company, outlining its purpose and long-term goals.

- Industry and Market: Offer a brief overview of the industry your business operates in and the market it serves.

- Company History (if applicable): If your business has a history or background that is relevant, include a short description of how and why the business was founded.

It sets the stage for the more detailed sections that follow in your business plan.

Step 3: Define Your Business Goals

Defining your business goals is a crucial step in your business plan that outlines what you aim to achieve with your business in the short term and the long term. These goals provide direction and serve as benchmarks for measuring your success over time.

When defining your business goals, it would be appropriate to consider the SMART strategy:

- Specific: Clearly articulate your goals. Instead of vague statements, use specific targets such as “Increase sales by 20% in the next year” or “Launch three new products by fourth quarter.”

- Measurable: Ensure that your goals are quantifiable so that you can track your progress. Set number-based goals like revenue figures, customer acquisition numbers, or market share percentages.

- Achievable: Set realistic goals that are challenging yet attainable given your resources and market conditions. It’s important to balance ambition with practicality even for intangible goals.

- Relevant: Align your goals with your overall business mission and vision. Every goal should contribute to the broader objectives of your business.

- Time-bound: Assign a timeline to each goal, whether it’s short-term (6-12 months) or long-term (3-5 years). This helps create a sense of urgency and keeps your team focused.

- Intangible Goals: Include goals that may not be easily quantifiable but are still essential to your business’s success, such as improving brand reputation, increasing customer satisfaction, or enhancing company culture.

Defining clear and well-structured business goals, not only guides your decision-making but also helps communicate your vision to stakeholders, including investors, employees, and partners. These goals serve as a roadmap for your business, help you stay on track and measure your success along the way.

Step 4: Describe the Business Management and Organization

In this step of your business plan, you will outline the structure of your business management and organization. This section is critical because it explains how your business is organized and who is responsible for specific activities, showcasing the experience and expertise within your team.

When describing your business management and organization, include the following key elements:

- Organizational Structure: Provide an overview of the structure of your company. This might include a hierarchy chart or a simple description of the different departments and how they interact. It’s important to explain how each part of the organization contributes to achieving the business goals.

- Management Team: Introduce the key members of your management team. For each individual, include their name, title, and a brief description of their role and responsibilities within the company. Highlight their relevant experience, skills, and achievements to demonstrate why they are well-suited for their positions.

- Ownership Information: Clearly state the ownership structure of the business. This includes details about the founders, investors, or any other stakeholders, along with their respective shares in the business.

- Advisors and Board of Directors: If applicable, mention any external advisors or members of the board of directors. Describe their roles and how their expertise contributes to the strategic direction and governance of the business.

- Legal Structure: Explain the legal structure of your business, such as whether it’s a sole proprietorship, partnership, limited liability company (LLC), or corporation. This is important for understanding the decision-making process and liability distribution within the company.

Describing the management and organization of your business provides readers with confidence in your team’s ability to execute the business plan. It shows that your business is structured in a way that supports growth and success, with the right people in the right roles. This section also helps investors and other stakeholders understand how decisions are made and who is leading the company.

Step 5: Explain Your Products or Services

This step of writing your business plan, gives details of the core offerings of your business in terms of the products or services. The section is crucial because it highlights what you are selling and why customers will want or need it.

Explaining your products or services thoroughly helps readers understand what your business offers and why it has the potential to succeed. It demonstrates that you have a clear understanding of your market and that your offerings are well positioned to meet the needs of your target market.

When explaining your products or services, include the following elements:

- Description of Products or Services: Provide an accurate description of each product or service your business offers. Explain what it is, how it works, and what makes it unique or superior to competing offerings.

- Value Proposition: Describe the benefits your products or services provide to your customers. Focus on how they solve a problem or fulfill a need better than other options available in the market. Your value proposition should clearly communicate why customers should choose your product or service over others.

- Pricing Strategy: Outline your pricing strategy, explaining how you have determined the prices for your products or services. Include any factors that influence pricing, such as production costs, market demand, or competitor pricing. If you offer different pricing tiers or packages, describe them here.

- Production and Delivery: Explain how your products are produced or how your services are delivered. This might include details about your supply chain, manufacturing processes, or service protocols.Mention key suppliers involved in the production or delivery of what you offer..

- Future Products or Services: If you plan to expand your catalog in the future, briefly describe these potential products or services. Explain how they will fit into your existing lineup and contribute to your business growth.

- Intellectual Property: If your products or services involve intellectual property, such as patents, trademarks, or proprietary technology, provide a brief overview of these assets and how they are protected.

Step 6: Conduct Market Research

Market research is a critical component of your business plan that helps you understand the industry landscape, identify your target audience, and assess your competition. This step involves gathering and analyzing data to make informed decisions about your business strategy.

Conducting thorough market research ensures that your business plan is grounded in reality. It confirms that you have a deep understanding of the environment in which your business will operate. It also demonstrates to potential investors and stakeholders that you have done your homework and are prepared to navigate the challenges and pursue opportunities in the market.

When conducting market research for your business plan,the following factors should be key for consideration:

- Industry Overview: Start by providing an overview of the industry in which your business operates. Discuss the current state of the industry, including trends, growth potential, and any challenges it faces. It sets the context for understanding where your business fits within the broader market.

- Target Market: Identify and describe your target market. Include demographic information such as age, gender, income level, education, and location, as well as psychographic details like interests, values, and buying behaviors. Understanding your target market is essential for tailoring your marketing and sales strategies effectively.

- Market Size and Growth: Estimate the size of your target market and its potential for growth. Use data from reliable sources to back up your estimates. Understanding the market size helps you gauge the potential demand for your products or services and plan for scaling your business..

- Customer Needs and Pain Points: Research the specific needs and pain points of your target market. Understanding what problems your customers are facing allows you to tailor your products or services to meet those needs more effectively than your competitors.

- Market Trends and Opportunities: Identify any emerging trends or opportunities in the market that could benefit your business. This could include shifts in consumer behavior, technological advancements, or regulatory changes. Being aware of these trends helps you stay ahead of the competition and adapt your strategy as needed.

- Market Entry Strategy: Based on your research, outline your market entry strategy. Explain how you plan to enter the market, attract customers, and establish your presence. This could involve pricing strategies, marketing campaigns, or partnerships that will help you gain traction quickly.

Step 7: Conduct Competition Analysis

A competition analysis is a vital part of your business plan that helps you understand who your competitors are, what they offer, and how your business can stand out in the market. This step involves a detailed examination of your competitors’ strengths and weaknesses, allowing you to identify opportunities and threats within your industry.

The following elements factors are key in conducting an extensive competition analysis:

- Identify Your Competitors: Start by listing your direct and indirect competitors. Direct competitors offer similar products or services to the same target market, while indirect competitors may offer different solutions that satisfy the same customer needs.

- Competitor Profiles: Create profiles for each of your main competitors. Include key information such as their business model, product or service offerings, pricing strategies, market share, and target audience. Understanding these aspects helps you gauge where your competitors stand in the market.

- Strengths and Weaknesses: Analyze the strengths and weaknesses of each competitor. Strengths might include strong brand recognition, loyal customer base, or superior product quality, while weaknesses could involve high prices, limited product range, or poor customer service. Recognizing these factors helps you position your business more effectively.

- Market Positioning: Assess how each competitor positions itself in the market. This involves understanding their unique selling propositions (USPs) and how they differentiate themselves from others. By comparing their positioning with yours, you can find ways to define what makes your business unique.

- Competitive Advantage: Identify the competitive advantages your business has over others. This could be anything from better pricing, higher quality products, innovative features, superior customer service, or a more strategic location. Clearly defining your competitive advantages will help you attract and retain customers.

- Barriers to Entry: Evaluate the barriers to entry in your market. These could include high startup costs, strict regulations, or strong brand loyalty among existing competitors. Understanding these barriers will help you develop strategies to overcome them and succeed in the market.

- Opportunities and Threats: Based on your analysis, identify any opportunities that you can exploit and threats that you need to mitigate. Opportunities might include gaps in the market that your competitors aren’t addressing, while threats could be potential new entrants or changes in consumer preferences.

Conducting a thorough competition analysis helps you understand the competitive landscape so as to develop strategies that will give your business a competitive edge. This analysis is crucial for making informed decisions and positioning your business for success in the marketplace.

Step 8: Make a Marketing and Sales Plan

Creating a marketing and sales plan is essential for translating your business ideas into actionable strategies that attract customers and grow revenue. This step is all about explaining how you will reach your target market, promote your products or services, and close sales effectively.

It would be appropriate to consider the factors below when writing your marketing plan for the business plan.

- Define Your Marketing Strategy: Begin by outlining your overall marketing strategy. This should include the key messages you want to convey, the brand image you aim to establish, and the unique selling proposition that sets your business apart from competitors. Your strategy should align with your business goals and reflect an understanding of your target market’s needs and preferences.

- Choose Marketing Channels: Identify the most effective channels to reach your target audience. This could include digital marketing tactics such as social media, email marketing, and search engine optimization (SEO), as well as traditional methods like print advertising, events, or direct mail. Select channels that best match your audience’s habits and your business model.

- Set Marketing Goals: Establish clear, measurable marketing goals that you aim to achieve. These could be specific outcomes like increasing website traffic by 30%, generating 500 new leads, or achieving a 10% conversion rate on a new product launch. Having defined goals helps you measure the effectiveness of your marketing efforts and adjust your strategies as needed.

- Outline Sales Strategies: Explain how you plan to convert leads into customers. It might involve defining your sales process, setting pricing strategies, and developing sales scripts or training programs for your team. Consider whether you will use a direct sales approach, an inside sales team, or a combination of both.

- Customer Acquisition Tactics: Develop specific tactics for acquiring new customers. This would include offering introductory discounts, referral programs, or bundling products and services. Your tactics should be designed to attract attention, generate interest, and encourage potential customers to take action.

- Retention and Growth Strategies: Plan for how you will keep existing customers engaged and encourage repeat business. This could involve loyalty programs, regular communication through newsletters, or providing exceptional customer service. Retaining customers is often more cost-effective than acquiring new ones, so it’s crucial to include strategies for fostering long-term relationships.

- Budget and Resources: Outline the budget you will allocate to your marketing and sales efforts, along with the resources required to execute your plan. This includes personnel, tools, and any external services you may need, such as marketing agencies or consultants. Ensure that your budget aligns with your overall financial projections.

- Monitor and Adjust: Finally, establish a system for monitoring the success of your marketing and sales plan. Regularly review key metrics like lead generation, conversion rates, and return on investment (ROI). Be prepared to make adjustments based on what’s working and what’s not, allowing you to optimize your strategies over time.

A professional marketing and sales plan is crucial for turning your business vision into reality. By clearly defining how you will attract and retain customers, you set the stage for sustained growth and profitability. This step ensures that your business is not only reaching its target audience but also effectively converting interest into sales.

Step 9: Make Operational Plans

An operational plan is an outline of the day-to-day activities required to run a business efficiently. This step focuses on the processes, resources, and logistics that ensure your business operations are smooth and effective, supporting your overall business goals.

Creating a detailed operational plan is essential for ensuring that all aspects of your business are working together seamlessly. This step helps you identify the resources and processes necessary to achieve your business goals, ensuring that your operations are efficient, cost-effective, and scalable as your business grows.

In designing an effective operational plan, it would be appropriate to consider a number of factors. Such factors include

- Daily Operations: Start by describing the daily operations of your business. This includes how your products are made or how your services are delivered. Explain the key processes that are essential to running your business, such as production, inventory management, customer service, and order fulfillment.

- Location and Facilities: Identify where your business will operate. Describe the physical location(s) of your business, including offices, production facilities, or retail spaces. If your business operates online, detail the digital infrastructure required, such as your website or e-commerce platforms.

- Technology and Equipment: List the technology, tools, and equipment necessary for your operations. This could include software for managing customer relationships, machinery for manufacturing products, or tools for providing services. Ensure you account for any specialized equipment that is crucial to your business operations.

- Supply Chain Management: Explain how you will manage your supply chain, including sourcing materials, managing suppliers, and ensuring timely delivery of products. This section should detail your relationships with suppliers, inventory management strategies, and contingency plans for any supply chain disruptions.

- Staffing and Human Resources: Detail your staffing needs and human resources management. Identify the key roles required to run your business and how you will recruit, train, and retain employees. Include information on the organizational structure, employee responsibilities, and any training programs that are necessary to maintain operational efficiency.

- Quality Control: Describe the measures you will take to ensure the quality of your products or services. This could involve setting quality standards, implementing regular inspections, and developing protocols for addressing any issues that arise. Quality control is essential for maintaining customer satisfaction and upholding your brand reputation.

- Logistics and Distribution: If your business involves the distribution of physical products, explain your logistics plan. This should include details on shipping methods, warehousing, and how products will be delivered to customers. For service-based businesses, outline how services will be scheduled, delivered, and managed.

- Operational Budget: Provide an overview of the budget required to support your operational plans. This should include costs related to staffing, facilities, technology, equipment, and any other resources needed to maintain day-to-day operations. Make sure your operational budget aligns with your overall financial projections.

- Monitoring and Evaluation: Finally, establish a system for monitoring and evaluating your operations. Regularly reviewing operational performance will help you identify areas for improvement, optimize processes, and ensure that your business is running as efficiently as possible.

Step 10: Create a Financial Plan

This step is the process of laying out your financial projections, funding needs, and strategies to ensure your business stays financially healthy and sustainable.Financial planning is the backbone of your business plan, providing a clear picture of how your business will manage its finances and achieve profitability.

Each of the points below should be considered critical in creating financial plans

Outline Your Financial Projections: Start by creating detailed financial projections, which include income statements, cash flow statements, and balance sheets. These projections should cover the next three to five years and provide a realistic estimate of your expected revenue, expenses, and profits.

Determine Startup Costs: Identify all the costs associated with starting up. Include expenses like equipment, location, inventory, and marketing. Understanding these costs helps you know how much capital is needed.

Develop a Funding Strategy: Outline how you plan to secure the necessary funding, whether through investments, loans, or personal savings. Clearly state how much funding you need and how it will be used.

Set Financial Goals and Milestones: Establish specific financial goals that your business aims to achieve, such as revenue targets or profitability rates. These milestones help you track progress.

Break Down Revenue Streams: Identify and explain your different revenue streams, such as product sales or service fees. This helps clarify where your income will come from.

Plan for Profitability: Explain your strategy for achieving profitability by optimizing expenses and increasing revenue. This ensures your business becomes profitable within your projected timeline.

Break Even Analysis: Conduct a breakeven analysis to determine when your business will start generating a profit. This critical milestone helps set realistic financial goals.

Account for Contingencies: Plan for financial uncertainties by setting aside a contingency fund. This provides a financial cushion for unexpected challenges.

Monitor and Adjust Financial Performance: Establish a system for regularly monitoring your financial performance and adjusting strategies as needed. Regular reviews help keep your business on track.

Step 11: Request for Funding

The request for funding section is where you clearly outline how much funding your business needs, why it is needed, and how it will be used. This step is crucial for attracting potential investors or securing loans by demonstrating the financial requirements and the value they will bring to your business.

The Request for Funding section is your opportunity to convince potential investors or lenders that your business is a solid investment. By clearly stating your funding needs and how the funds will be used, you help build confidence in your business’s financial viability and growth potential.

It is appropriate to consider the following factors as key for writing an outstanding funding request.

- State the Amount Required: Begin by specifying the exact amount of funding you are seeking. Be precise and ensure that the figure aligns with the financial projections and startup costs outlined in your financial plan.

- Explain the Purpose of the Funds: Clearly explain how the funds will be used within your business. This could include purposes such as purchasing equipment, hiring staff, launching marketing campaigns, or expanding operations. Highlight how each allocation will support your business goals.

- Outline the Funding Timeline: Provide a timeline for when the funds are needed. This helps potential investors or lenders understand the urgency and plan their investment accordingly. Break down the funding needs over time if the requirements are spread out over different stages of your business.

- Describe the Financial Strategy: Highlight how the funding will be managed and how it will contribute to achieving profitability. This includes explaining your repayment plans if seeking a loan or how investors can expect returns on their investment.

- Share the Ownership Structure: If applicable, describe what investors will receive in return for their investment. This might include equity in the company, a share of profits, or other benefits. Be clear about the terms to avoid any misunderstandings later.

- Provide a Contingency Plan: Include a brief discussion of your contingency plan in case the required funding is not fully secured. This demonstrates to potential investors that you are prepared for various outcomes and have strategies in place to manage financial challenges.

Step 12: Include Extra Details in the Appendix

The appendix is the final section of your business plan where you can include any additional information that supports your plan but could not fit into the main sections. This step is about ensuring all essential details and documents are available to provide further clarity and support to your business plan.

The appendix serves as a repository for all the extra details that enhance your business plan, providing a complete and thorough understanding of your business. By including these additional documents, you ensure that potential investors or stakeholders have access to all the information they need to make informed decisions.

Ensure you include the following elements for a good appendix.

- Supplementary Documents: Include any documents that provide additional detail or support for the sections of your business plan. This might include resumes of the management team, product images, marketing materials, or technical specifications.

- Market Research Data: If you conducted detailed market research, include the full reports, data analysis, or survey results in the appendix. This allows readers to dig deeper into the research that informed your business decisions.

- Legal Documents: Add any relevant legal documents, such as business licenses, permits, contracts, or intellectual property registrations. These documents demonstrate that your business is compliant with legal requirements.

- Financial Statements: Include detailed financial statements or projections that were summarized in the financial plan section. This can include balance sheets, income statements, and cash flow statements for those who want to explore your financials in greater detail.

- Partnership Agreements: If your business involves partnerships or collaborations, include any agreements or contracts that outline these relationships. This helps clarify the roles and responsibilities of each partner.

- Product or Service Descriptions: If your business offers a variety of products or services, include detailed descriptions, technical specifications, or any other relevant information that was not covered in the main sections.

- Visuals and Diagrams: Attach any visuals, diagrams, or charts that help illustrate key points in your business plan. This could include organizational charts, product photos, or process flow diagrams.

What are the Tips for Writing a Business Plan?

Here are essential tips to ensure that your business plan is professional and effective:

- Know Your Audience: Design your business plan to the specific needs and expectations of your audience, whether they are investors, lenders, or internal stakeholders. Use language and details that resonate with them and address their primary concerns.

- Be Clear and Concise: Avoid jargon and overly complex language. Your business plan should be easy to read and understand, providing clear information that gets straight to the point.

- Support Your Claims with Data: Use reliable data and research to back up your assumptions, projections, and strategies. This adds credibility to your business plan and builds trust with your audience.

- Focus on the Executive Summary: Since the Executive Summary is often the first (and sometimes the only) part that gets read, make sure it effectively highlights the key points of your business plan. It should capture attention and entice the reader to explore the rest of the document.

- Regularly Review and Update: A business plan is a living document that should evolve as your business grows and market conditions change. Regularly reviewing and updating your plan ensures it remains relevant and aligned with your current business goals.

How Long Does It Take to Write a Business Plan?

It takes 5-10 days to write a good business plan, but complex business plans take up to 60 days.The time required to write a business plan varies depending on the complexity of the business and the depth of research involved. Business plan writing involves several stages, including initial research, drafting, and refining the document to ensure it covers all essential elements.

For a simple business, it might take a few weeks to develop a comprehensive plan, while more complex businesses could require several months to fully flesh out their strategies and projections. After the initial draft, thorough review is crucial to catch any errors, ensure clarity, and fine-tune the details. Engaging business plan writers can expedite the process, as their expertise allows them to quickly understand your business model and produce a professional document, often reducing the overall time required to complete the business plan.

Who Can Help with Writing a Business Plan?

Companies offering business plan services help with writing professional business plans. When it comes to writing a business plan, seeking help from professionals can make a significant difference in the quality and effectiveness of the final document. A business plan writing company specializes in writing custom business plans that meet the specific needs of your business and appeal to investors or lenders.

These companies hire experienced business plan writers who are well-versed in various industries and understand the key components that make a business plan compelling. Additionally, they offer insights and strategic advice, helping you refine your ideas and present them in a way that maximizes your chances of success. Whether you do not have adequate time or want to ensure that your business plan is polished and professional, a business plan writing company can provide the expertise and support you need.